Real estate market grows to €11.5 billion by 2024

The Dutch property market is on the rise again. Last year, a total of EUR 11.5 billion worth of buildings changed hands. That is 28% above the 2023 low. Lower interest rates and prospects of a further decline made real estate more interesting for investors. This year, that trend continues and investors are buying for over EUR 13 billion, a plus of almost 16%. This is according to the new investment market report by real estate consultant Colliers.

The high transfer tax of 10.4% and adverse tax measures such as the box 3 rules limited the recovery. "The brakes were still on investors," says Dré van Leeuwen, director of investments at Colliers. "Nevertheless, we can say that the sector has found the way up."

Netherlands lagging behind in hotel investment

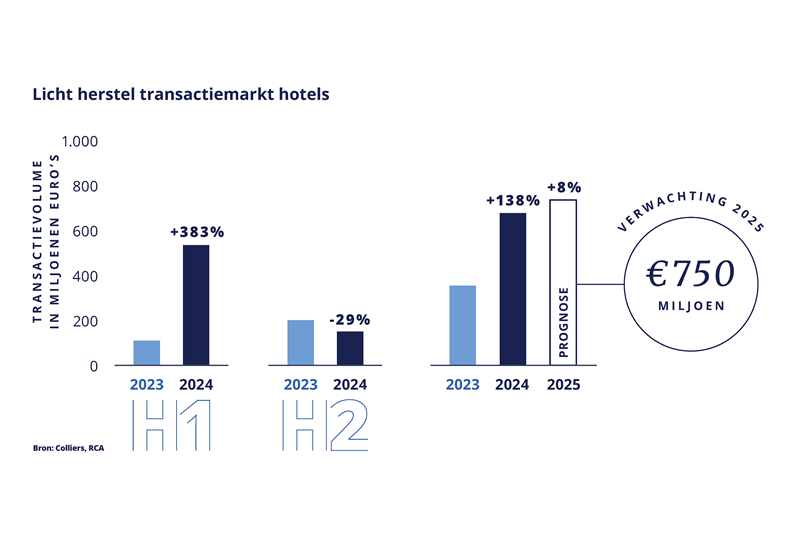

In the Netherlands, the transaction market for hotel real estate is recovering cautiously compared to other European hotel markets, where there has been a strong rebound. Here, there were only 19 transactions in 2024. The total transaction volume reached EUR 692 million. That is an increase of 138% compared to the 290 million euros in 2023, the year when the investment market bottomed out. More larger transactions are expected to take place in 2025, due to increasing interest from foreign investors, among other things. "We expect investment volume to rise to €750 million, up 8%," said Jan Hein Simons, director of hotels at Colliers.

Heeft u vragen over dit artikel, project of product?

Neem dan rechtstreeks contact op met VDW Estate Agents in Hotels.

Contact opnemen

Contact opnemen