Architectural firms see slight recovery, but slow permit issuance and stagnation among developers are putting the brakes on production.

Four out of ten architectural firms assess the market situation as favourable, and half as reasonable. This presents a stable and moderately positive picture compared to the spring. This is evident from the BNA Economic Survey Autumn 2025, conducted by Panteia on behalf of the Royal Institute of Dutch Architects (BNA).

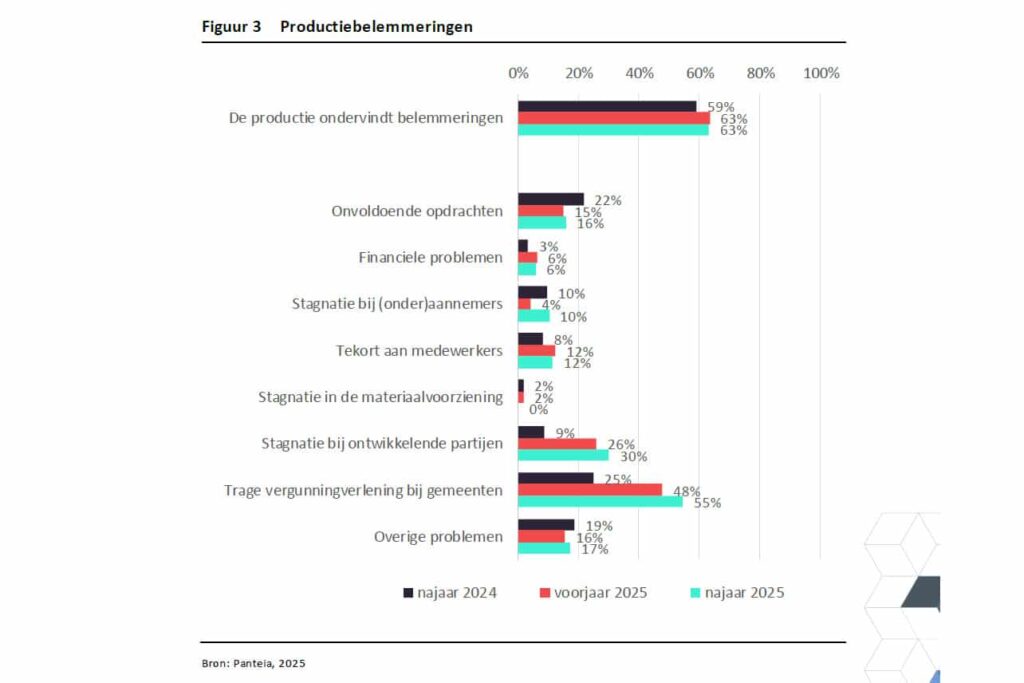

Production development is divided: 27% of the agencies have seen an increase in production over the past three months, while an equally large group has experienced a decline. At the same time, almost two-thirds of agencies (63%) are experiencing obstacles to production. That proportion has remained virtually unchanged since the spring of 2022. The slow granting of permits by local authorities is most often cited as a bottleneck, followed by stagnation among developers.

Work in progress slightly down

The average workload this autumn is 4.9 months, slightly lower than the 5.3 months in the spring. One-fifth of agencies consider the workload to be large, while 29% considers it to be small.

Positive expectations

Looking ahead, the outlook is cautiously optimistic. For the fourth quarter, 30% of the agencies expect an increase in new orders, and for 2025 as a whole, 38% foresee an increase compared to the previous year. This continues the upward trend that has been visible in the forecasts since 2023.

Turnover expectations are also changing: 391 agencies expect an increase throughout 2025, compared to 201 agencies that foresee a decline compared to 2024. In addition, nearly 40% of the agencies expect higher rates, while none of the agencies expect a decrease in rates. The workforce is expected to remain largely stable, although nearly one-fifth of the agencies expect growth.

Transformation and sustainability on the rise

On balance, agencies expect an increasing importance for all types of assignments. Transformation, renovation, reuse and sustainability are widely mentioned in particular. Clients such as project developers are most often seen as a growth market, while half of the agencies are not active for clients in healthcare and education.

By market sector, the outlook is most positive for residential construction and mixed-use projects – traditionally the sectors in which many agencies are active.

Regulatory burden is increasing

In addition to the economic figures, the regulatory burden was also examined. Most obstacles are experienced in relation to licensing, environmental regulations and appeal procedures. The administrative burden is high: more than six in ten agencies spend 10% or more of their operational time on complying with obligations. For almost a quarter of the agencies, this is even 20% or more. Smaller agencies in particular are relatively more heavily burdened. A large majority (71%) expect the regulatory burden to increase further in the next two years.

Tenders: participation mainly among larger agencies

The survey also shows that four in ten agencies participate in European or Dutch tenders. This percentage varies greatly depending on size: for agencies with 5 FTE or more, it is 81%, while for smaller agencies it is only 22%. The main reasons for not participating (anymore) are a lack of capacity, high participation requirements and costs. On average, 81% of turnover comes from tenders; for larger agencies, this share is considerably higher (161%) than for small agencies (51%).