Decline in international conferences threatens knowledge economy

Business events and congresses are important for the Dutch knowledge economy. The Netherlands is one of the top countries in Europe when it comes to organising and hosting business events and congresses, but the question is for how long. Due to the contraction of Schiphol Airport, the unpredictable development of the tourist tax and relatively limited budgets to attract new congresses to our country, our position is under pressure.

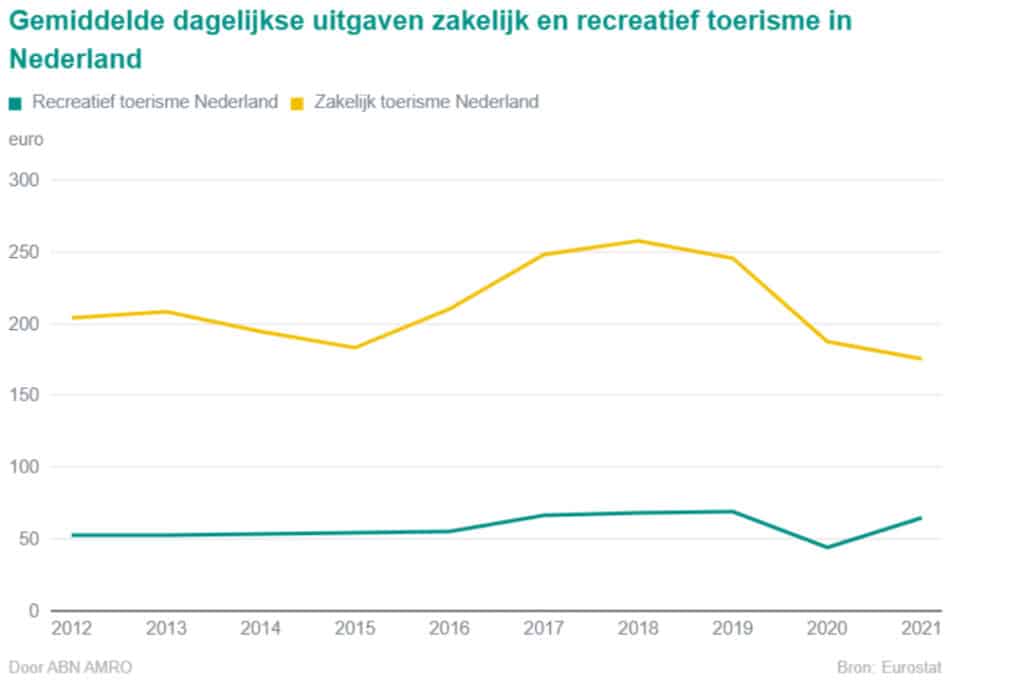

The Netherlands' major cities are among the top in Europe when it comes to organising and hosting business events and conferences. This generates knowledge and money. Business visitors generate as much as three to four times more revenue per day than leisure visitors. Per stay, an individual business traveller spends 633 euros. The conference visitor takes the crown and spends per stay 1,131 euros on average. According to market researcher Response business events and conferences generated a total of €9.1 billion in 2019. This makes business tourists an important source of income for the Netherlands. Moreover, the business events market generates 136,000 jobs, 71,000 of which are in the sector itself and 65,000 in supplying companies.

No nuisance

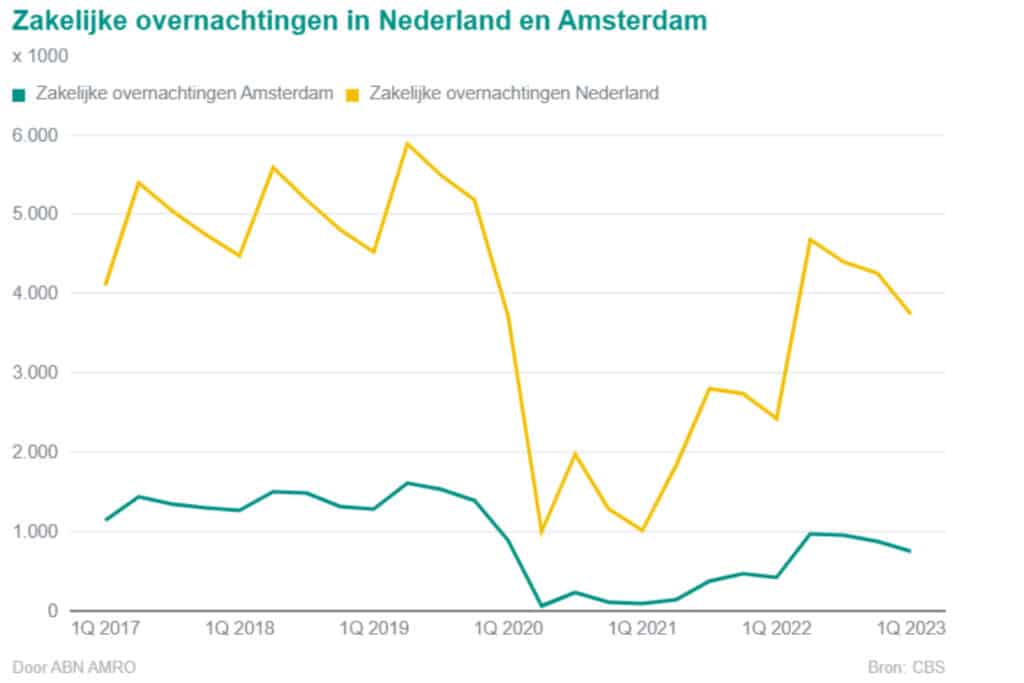

Congress delegates also cause little nuisance, according to studies by the Amsterdam municipality. Business overnight stays by congress delegates mainly take place in the second quarter of the year. In the busy summer months, there are hardly any congresses in our country. The big differences in nuisance are rarely made in debates about alleged over-tourism in summer.

Amsterdam increasingly irrelevant

ABN AMRO is concerned about policymakers' lack of interest in business events. Foreign cities lure congresses with free public transport or with a welcome reception at a special location. In the Netherlands, this hardly happens, if at all. This puts pressure on the development of the Dutch knowledge economy.

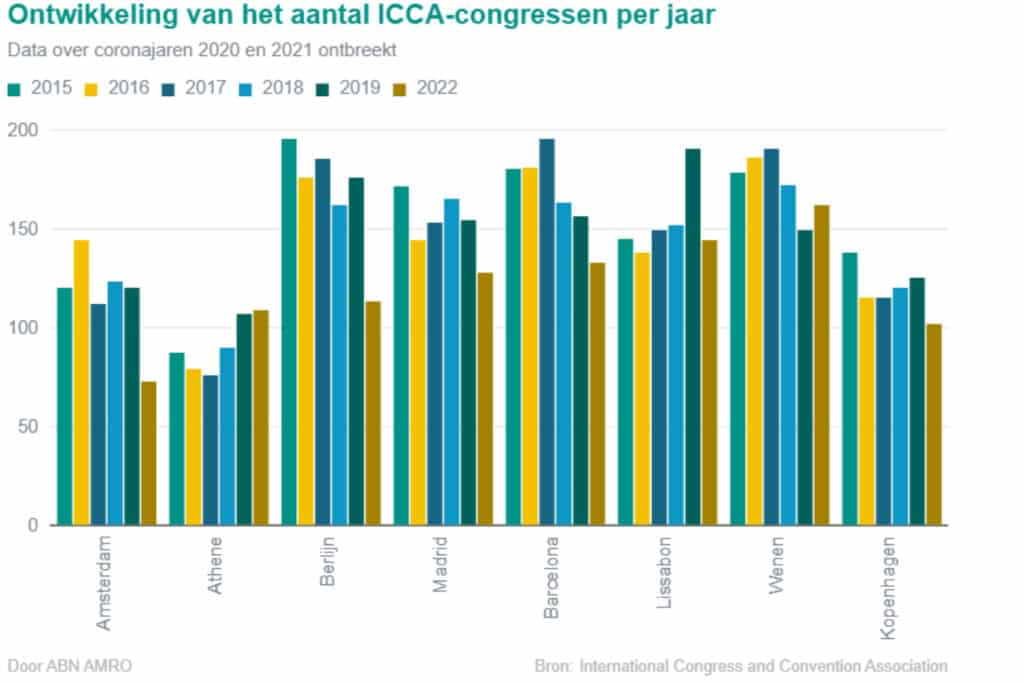

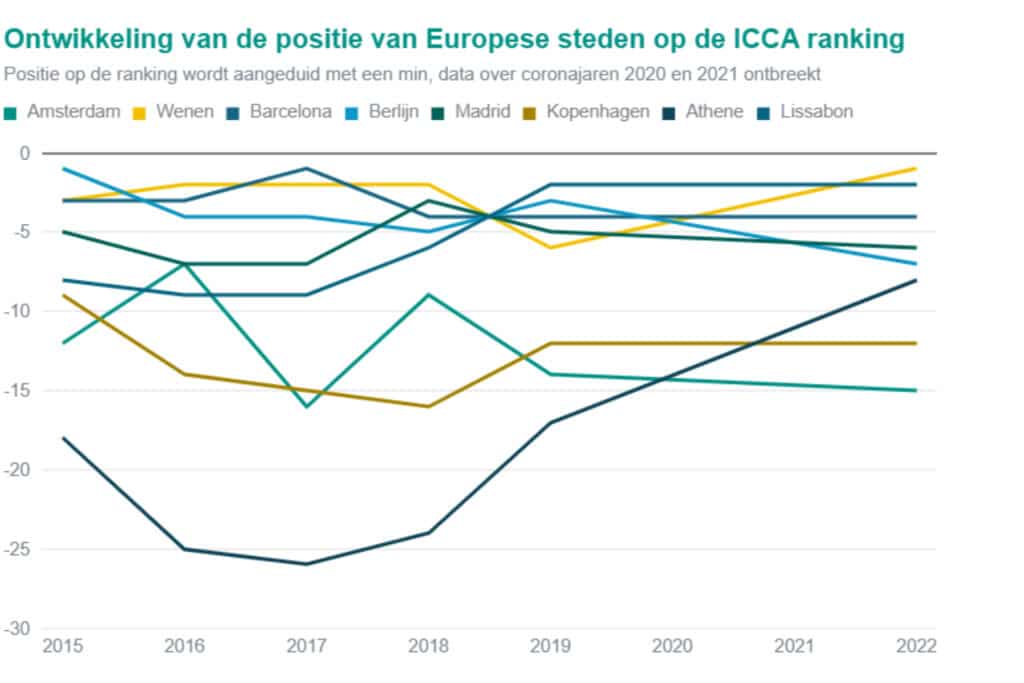

The number of leading congresses in the Netherlands has been declining since 2016. The ICCA rankings and ICCA's performance index are a measure of how the Netherlands is doing in the world of congresses. The ICCA report indicates that the most important factors for choosing a destination are the quality and availability of venues, hotels and infrastructure, accessibility and safety, image and reputation, costs and subsidies, and support and involvement among the local population. In the rankings, Amsterdam in particular is dropping significantly as a congress location. At its peak in 2016, 144 congresses took place in Amsterdam; by 2022, this will have halved to 73. Incidentally, ICCA only registers the leading congresses. By definition, these are international meetings with at least 50 participants on location. In addition, the congress must take place regularly, not just once. There must also be rotation between at least three countries of the same congress.

No Dutch city has been among the winners of the best business destinations in Europe since 2012, data from Europe's Best MICE Destination shows:

- 2012: Berlin

- 2013: Vienna

- 2014: Paris

- 2015: Istanbul

- 2016: Lisbon

- 2017: London

- 2018: Madrid

- 2019: Milan

- 2020: Vienna

- 2021: Madrid

- 2022: Berlin

- 2023: Not yet announced

Rotterdam as an exception

With its destination performance index, ICCA also measures the attractiveness of other Dutch cities. Utrecht and Maastricht are ranked 42 and 44 respectively, while The Hague is 35. Rotterdam has been on the rise for some time and only has to beat 22 cities.

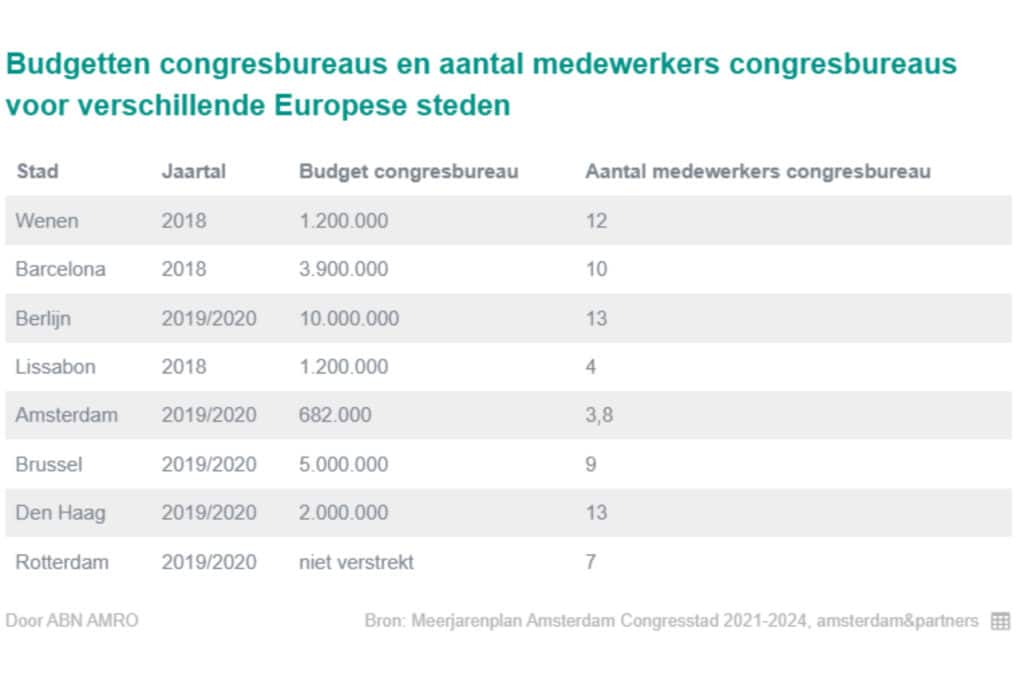

Compared to other European cities of similar size (between 0.5 and 1 million inhabitants), the number of congresses and congress participants in Rotterdam is relatively high, especially for a country's second city. Rotterdam Partners, which focuses on promoting the city internationally, managed to attract 24 new congresses last year. Examples include the maritime business fair Breakbulk Europe, which focuses on making shipping more sustainable. Another example is World Hydrogen Summit & Exhibition, which helps channel investment in hydrogen. Compared to Amsterdam, Rotterdam puts relatively much manpower into attracting and retaining congresses, according to a report by amsterdam&partners, which promotes the reputation of the capital. Other popular destinations such as Vienna, Lisbon, Madrid and Barcelona are also investing substantially more in business meetings with social relevance. According to the Office du Tourisme et des Congrès de Paris (OTCP), the budget for promoting Paris as a meeting destination in 2020 was around €17 million. To keep up with these cities, the Netherlands will have to make more budget available to make Dutch cities attractive as international meeting destinations.

The shrinkage of Schiphol

Some cities in the ICCA rankings stand out positively. Athens in particular is doing well. The Greek city was 26th in the ICCA rankings as recently as 2016, but now occupies the 8th spot, well above Amsterdam. Lisbon is also among the cities with the highest growth. The number of congresses increased by as much as 62 per cent between 2012 and 2019. Barcelona is performing extremely stable and has been in the top 5 since 2012.

All the cities in the top 10 have nearby airports. Without exception, air traffic controllers at relevant airports are counting on a growth in the number of flights, according to a reporting from Eurocontrol.

In the Netherlands, the cabinet wants to shrink the national airport. The Chamber's decision to declare this plan non-controversial means the cabinet can implement the plan without first being approved by a new coalition.

Decision-making around Schiphol may be a reason for Amsterdam's drop in the ICCA ranking. In no other country in the world is the number of flights shrinking, the aviation umbrella Barin reported to the Algemeen Dagblad. A recent study by CE Delft confirms that Belgium, Germany, the UK and France have significantly lower ambitions to reduce or regulate air traffic.

A decrease in the number of flights at Schiphol will limit the accessibility of the Netherlands and drive up prices. Many companies will therefore want to curb this rising cost by reducing the number of trips at Schiphol. According to SEO Economic Research, the government's proposed shrinkage of Schiphol to 440,000 flights would lead to a decrease in employment in the Schiphol cluster and supplying sectors by over 13,000 people. Production (added value) would fall by Approximately two billion euros decrease. That does not include the damage caused by less leading conferences in our country.

CE Delft's analysis also looked at the environmental and noise benefits of the envisaged airport shrinkage. Shrinkage costs Dutch society €2 to €9.5 billion, CE Delft calculated in a recent analysis, where growth will cost up to 2.5 billion. In addition to direct costs, the analysis explicitly takes into account environmental and noise benefits with fewer flights. The large bandwidth is caused by whether or not the hub function disappears in a shrinkage scenario. According to CE Delft, the disappearance of the hub function causes additional damage.

Accountancy firm PWC confirms that with fewer flights, the overall welfare of the Netherlands will decrease in all scenarios, even when taking into account the noise, climate and environmental impacts. However, in its reckoning, the firm argues that fewer foreign tourists are offset by more domestic holidaymakers. In the international convention market, however, such a substitution is not an issue.

According to KLM, PWC and its client, the Ministry of Infrastructure and Water Management, calculated with figures from 2014 to arrive at shrinkage, while now, almost a decade later, the fleet at the airport is of a very different composition. "This does not include the effect of the newest aircraft types, which are 50 per cent quieter than their predecessors," reports KLM president Marjan Rintel. This means that Schiphol needs to shrink a lot less than suggested in the report, because the fleet is quieter than calculated.

Tourist tax

Besides accessibility, predictability of local conditions also plays an important role in the choice of a city for conference organisers. International conferences are booked several years in advance. A predictable development of the tourist tax is important for this. In Amsterdam, the tourist tax increase for the following year is set every year in October. These are often substantial amounts. Once again, a tourist tax increase is on the table, with the aim of a structural increase in municipal revenues of at least €30 million. This would lead to a more than doubling of the tourist tax rate since 2016. Moreover, there is talk of further increases, up to 30 per cent of the room rate. This undermines organisers' confidence in the local government. Other popular convention venues, such as Madrid, London and Copenhagen, charge no or much lower tourist taxes.

Number of congresses according to ICCA and tourist tax for different European cities

Amsterdam and the other Dutch conference cities would do well to create an exception situation for business events. This could be done by granting subsidies or by making tourist tax increase(s) apply only to busiest summer months: July and August. After all, most business events do not take place during these periods.