Commercial property investment volume grows 15% by 2025

Investment volume of €13 billion in commercial property mainly driven by domestic capital

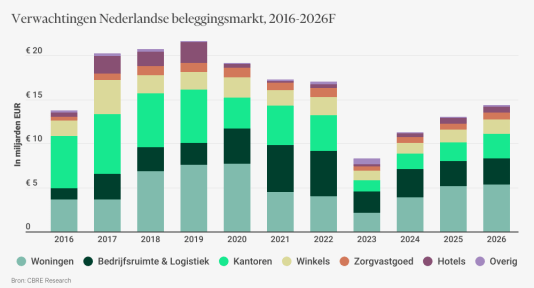

Total investment volume in Dutch commercial real estate reached €13 billion in 2025, according to the Real Estate Market Outlook Report 2026 by CBRE Netherlands, part of the listed CBRE Group, the world's largest real estate consultancy. This is an increase of 15% compared to 2024 and comes mainly from investments in residential, office and logistics properties, with foreign investors largely absent.

Foreign capital remains absent

Interestingly, the recovery was almost entirely driven by domestic capital. Foreign institutional investors remained largely on the sidelines in 2025. This reluctance is linked to unfavourable legislative, regulatory and fiscal measures, such as the higher transfer tax, the abolition of the FBI regime and continued policy uncertainty, especially in the housing market.

Housing, offices and logistics the main drivers in 2025

The growth in investment volume in 2025 is mainly driven by three sectors: residential, offices and logistics.

- In the housing market was the outpump wave was the main driver of investment volume growth: the price differential between purchases and outpump sales averaged 56%. Residential complexes were purchased on average in 2024 and 2025 for €3,165 per sq m and sold individually for around €4,925 per sq m.

- In the logistics sector investment volume came in at €2.9 billion, some 11% lower than in 2024. At the same time, the market is clearly stabilising: transaction dynamics visibly increased in the second half of 2025, indicating a cautious recovery. Investors mainly focused on modern distribution centres in strategic locations, suitable for automation and operational efficiency.

- The office market with an investment volume of €2.1 billion, showed an increase of more than 19% compared to last year. The recovery is mainly driven by the occupier market. There is continued demand for easily accessible and sustainable offices, while supply is limited and new construction and renovation lag behind. As a result, rents are moving up under pressure.

Erik Langens, Managing Director CBRE Netherlands: “We see that the leasing out of rental housing is weighing down supply especially in student cities, while affordable housing there is essential for talent and knowledge development and thus the competitiveness of the Netherlands. This directly affects the foundation of the Dutch knowledge economy. At the same time, we see pension funds showing increasing interest in student housing, which has been designated by the European Union as a social infrastructure. This segment offers an opportunity to connect social impact and long-term returns in a sustainable way.

Outlook 2026: growth continues, focus shifts

For 2026, CBRE expects a further increase in investment volume of around 10.5%. Capital next year is expected to shift to more operational properties with stable user demand and clear rental growth potential, such as student housing and senior living.

Langens on developments: “The investment market is once again showing the same dynamics as before corona. Liquidity is returning and transactions are following each other faster, despite geopolitical uncertainties. The biggest problem in the Dutch real estate market is the lack of foreign capital. For a structurally healthy investment climate, it is crucial that the Netherlands also remains attractive internationally for capital that is needed for sustainability and innovation.”